36+ co signer requirements for mortgage

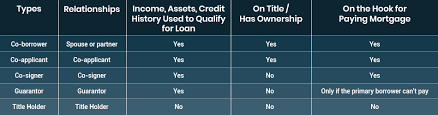

Get the Right Housing Loan for Your Needs. The cosigner will often sign both the note and security instrument.

Things To Avoid After Applying For A Mortgage Infographic Keeping Current Matters

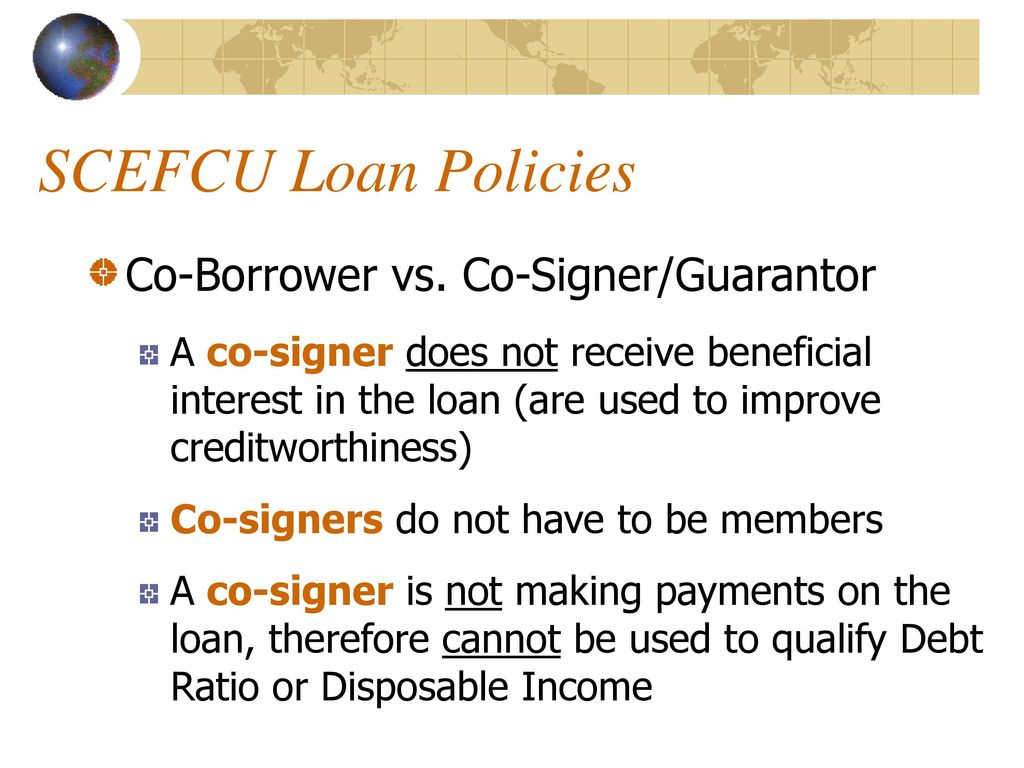

Web Generally speaking a cosigner will be on the loan documents such as the note and the mortgage and deed of trust.

. Begin Your Home Loan Search Right Here. The cosigner will not be on title to the property. Lock Your Rate Today.

Apply Get Pre-Approved Today. Get Instantly Matched With Your Ideal Mortgage Lender. Web A co-signer should have better credit and income than the primary borrower.

Co-signers are expected to have a good income and. Web Minimum credit score for a mortgage with a co-signer As a co-signer youll need to meet the minimum credit score requirements for the type of loan the borrower is trying to qualify for. Get Instantly Matched With Your Ideal Mortgage Lender.

Web A co-signer takes full responsibility for paying back a loan along with the primary borrower. Ad Explore Quotes from Top Lenders All in One Place. Ad Compare Home Financing Options Online Get Quotes.

Web A co-signerusually a relative or friendis someone who typically doesnt live at the property aka a nonoccupant co-borrower This person physically co-signs the. Web There are three areas that need to be checked to be able to qualify for a mortgage. Ad Dedicated to helping retirees maintain their financial well-being.

Apply Get Pre-Approved Today. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web Cosigners do not get property rights to the home and cannot sell the home if you default.

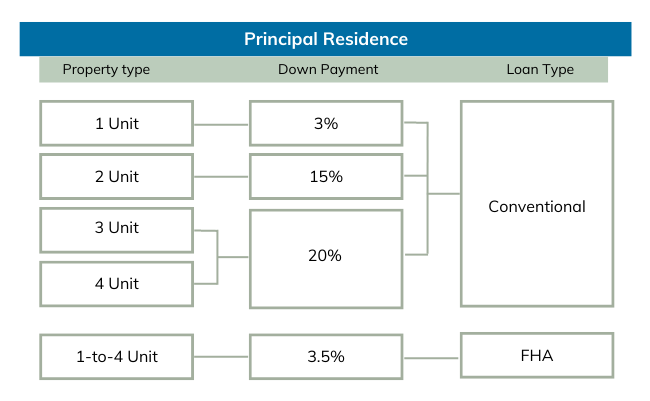

No SNN Needed to Check Rates. The occupying borrower is purchasing a one-unit principal. Get Your Home Loan Quote With Americas 1 Online Lender.

Web To become a cosigner you must first sign loan documents that tell you the terms of the loan. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. When you go in to apply for a mortgage with a bank or other traditional.

For co-signing you need to. See if you qualify. The co-signer is obligated to.

If the primary borrower falls behind the cosigner can make the payments to keep the loan. Get Your Home Loan Quote With Americas 1 Online Lender. Web Technically anyone is eligible to be a co-signer but to be approved by the mortgage lender a co-signer must be financially fit.

Web The following requirements must be met by borrowers with no established credit in order to qualify for a conventional mortgage loan. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Web The process for cosigning a mortgage is the same as applying for a regular mortgage.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web A cosigner with a steady paycheck and low debt-to-income ratio DTI may give the lender assurance that someone will be able to make the mortgage payments. Low Fixed Mortgage Refinance Rates Updated Daily.

Ad Compare the Best House Loans for March 2023. Ad Compare the Best House Loans for March 2023. The cosigner must sign all loan documents except the security instruments to.

Your credit score your income and your debt to income ratio. In some cases a co-signer is a family member or friend of the loan applicant such as a. Web USDA loans also have unique requirements when it comes to co-signers.

Often a co-signer will be a family member. Compare Offers Side by Side with LendingTree. Web Cosigner Requirements For Becoming A Mortgage Co-Signer What credit score does a cosigner need.

Web Co-Signers and Mortgage Insurance When home buyers have less than 20 percent available for a down payment they are required to have mortgage insurance. Web To qualify as a cosigner youll need to provide financial documentation with the same information needed when you apply for a loan. Web Typically a co-signer on a mortgage will be a parent spouse friend or a family member.

The LTV or CLTV ratio is less than or equal to 80. Lock Your Rate Today. Ad Compare Home Financing Options Online Get Quotes.

USDA loans typically require an applicant to have at least a 640-credit score. Ad Compare More Than Just Rates. Find A Lender That Offers Great Service.

The Best Lenders All In 1 Place. The lender also must give you a document called the Notice to. Web For manually underwritten loans if the income of a guarantor co-signer or non-occupant borrower is used for qualifying purposes the occupying borrower s must make the first 5 of the down payment from their own funds unless.

Ad Compare Lowest Mortgage Refinance Rates Today For 2023. But there arent clear limits on who can co-sign for a mortgage. Income and assets are verified and the cosigners credit and job history are vetted for stability.

Everything You Need To Know About Cosigning A Mortgage Loan Mares Mortgage

Georgia Banking Company Linkedin

Mortgage Cosigner Explained For First Time Home Buyers

Lending The Sce Way New Fsc Training Revised October Ppt Download

Co Signer Vs Co Borrower What S The Difference Youtube

Cosigning On A Mortgage Things You Need To Know Loans Canada

Viewgol Viewgol Twitter

Do I Need A Cosigner For A Mortgage The Ascent

Cosigning A Mortgage What You Need To Know Credible

Cosigning A Mortgage What You Need To Know Credible

How To Use A Co Borrower For Mortgage Loans In 2023

Mortgage Cosigner Explained For First Time Home Buyers

By Order Of The Commander Air Force Recruiting Air Force Link

Banking And Loan Businesses For Sale Bizbuysell

Mortgage Co Signer Or Guarantor In New York Nestapple

How A Mortgage Co Signer Can Help You Buy A Home

What Is The Minimum Credit Score For A Mortgage With A Co Signer Cain Mortgage Team